Selecting the Right Credit Card Program for Your Bank

Oct. 10, 2025

Is it time to evaluate your bank’s credit card program?

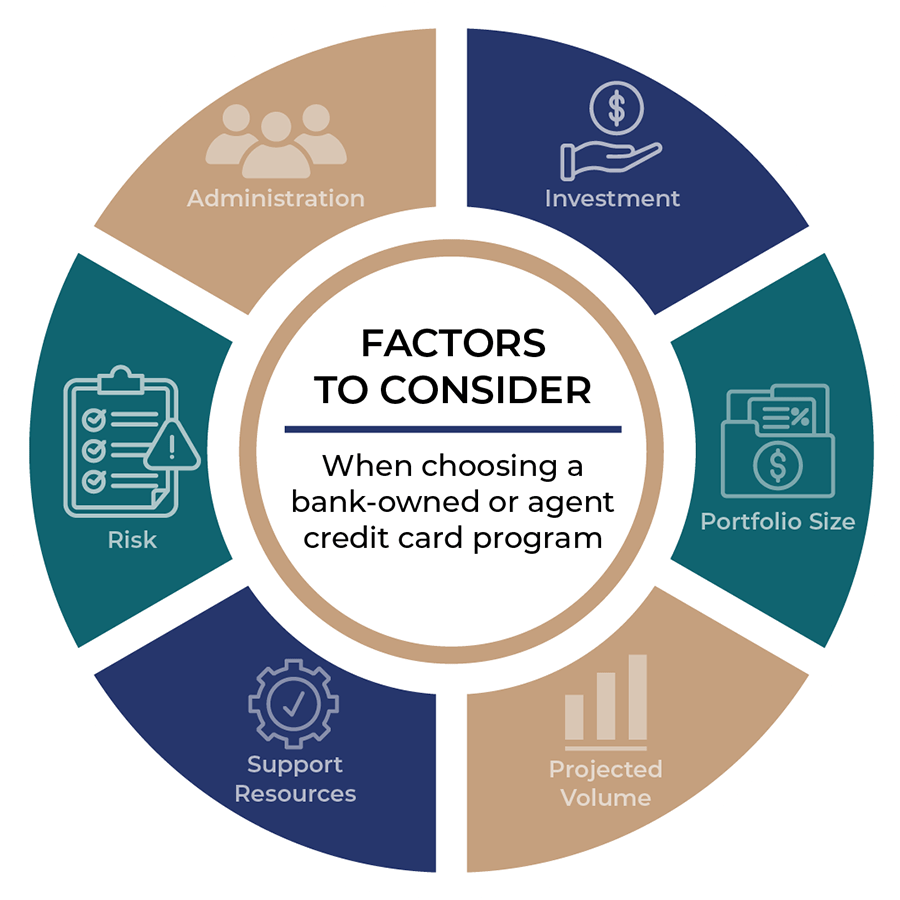

If you have been considering adding or re-evaluating a bank credit card program, you may be researching the type of program that will best fit your bank’s strategic goals — a bank-owned program or an agent model. Both options provide advantages depending on your appetite for risk, investment resources, portfolio size, projected volume, availability of support resources, and infrastructure in place for administration.

Bank-owned Credit Card Program

Bank-owned Credit Card Programs provide more control. You have the freedom to make decisions about interest rates, fees, card types and enhancements. You can also make underwriting decisions in alignment with your bank credit policy. While this option provides the most flexibility, it also requires the highest administration and incurs greater expense, so it is important to consider your ability to support the factors that drive program profitability. The implementation timeline may be longer with this option depending on your current infrastructure and vendor contracts.

Agent Credit Card Program

Agent Credit Card Programs are generally turnkey programs that help your bank stay top-of-wallet through bank-branded cards and take limited resources to set up or maintain. These may be good options if you are just getting started, you are looking to sell your current bank-owned portfolio, or you are looking to launch a new brand. Your bank benefits from this low-risk program that requires limited resources and provides program revenue share. The agent owns the program, managing underwriting, fraud monitoring and loss, collections, and customer support. Some agent programs even include marketing support at no additional cost.

Next Steps in the Evaluation Process

Whether you have determined to move forward with a bank-owned credit card program or an agent model, consider contacting Bankers’ Bank of Kansas for more information. We offer both program models and can provide a complimentary program comparison based on your unique situation.